Silicone Baby Nose Cleaner,Silicone Nose Cleaner,Baby Nose Aspirator,Baby Nasal Aspirator Tweezer Hubei Daxin Electronic Technology Co., LTD , https://www.aiwellgroup.com

Where should China's shipping industry in the trough go?

On January 28, 2016, the BDI index (the Baltic Composite Freight Index), which has been falling, has reached a new low of 325, the lowest since 1985. Various "zombie ships" and "no ships at sea" remarks have been seen in major media. If you don't let the friends who know or don't understand the shipping industry are confused, you can't help but ask what is happening in China's shipping industry.

Because China is a typical coastal continental country, the land area is huge, the water surface width of the inland waters is narrow, the depth is shallow, and the road network and railway network are developed. Therefore, the inland river and coastal shipping account for a relatively small role in the entire transportation system. limited. Therefore, China's shipping industry is mainly based on ocean transportation, but this part of the competition is extremely fierce. The three major shipping entities left in the past planned economy (COSCO, China Shipping, and Sinotrans) have developed targeted ocean transportation development plans. International ocean transportation is also the competition of many shipping giants abroad. Therefore, the shipping industry is China's most international and open free competition market, and it is naturally most vulnerable to fluctuations in international freight rates.

The most intuitive indicator of international freight rate fluctuations is the Baltic Index (BDI), which is calculated by the Baltic Shipping Exchange based on the weight of several major ship types. The index is derived from the actual real-time freight rate, so it reflects the current price level of the capacity market to the greatest extent. Therefore, in contrast to the 325-point BDI historical low mentioned earlier, it can be seen that the current world shipping market is weak and can also see the grim situation in China's shipping market.

Having talked so much, it is important to explain the truth: China's shipping industry has been closely linked with the world shipping industry. The current problem in China's shipping industry is the result of the overall dilemma facing the world shipping industry and the compounding of its regional problems. .

The following paper will explore the core issues of the development of the world shipping industry: capacity demand, capacity supply and industry specific issues.

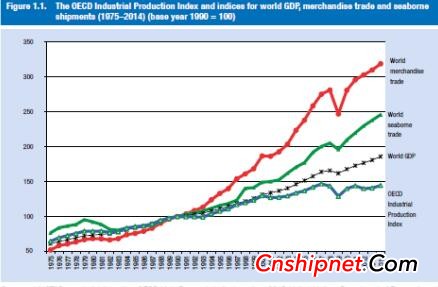

The capacity demand, in a straightforward way, means exactly how many goods need to be transported by the ship? Since international shipping accounts for more than two-thirds of global cargo transportation, the discussion of transportation demand is in fact inseparable from the study of the world economy. The reason can be seen from Figure 1.

In recent years, the recovery of the world economy is lower than expected, the pessimism in the international market is strong, the growth of China's economy and the structural transformation have directly led to insufficient demand for global capacity.

Among the three points, the first two points are easy to accept, and the role played by the Chinese economy in the world economy and the world shipping market is often easily questioned by the public.

Truth 1: The Chinese economy does play a very important role in the development of the world shipping industry.

As a powerful engine for the recovery of the world economy, China basically maintains a growth rate of 7% of GDP every year, far higher than the growth rate of world GDP (about 2.4%) and US GDP (about 2.3%). At the same time, as the world's largest consumer of iron ore and energy, and the busiest import and export country, the development of China's economy is closely related to the world economic situation, and more directly related to the global demand for iron ore, crude oil, containers and chemicals. .

How has China developed from a nameless name to a significant role in the world shipping industry today? Below we will tell a story about the world industrial revolution, the division of labor in the world, labor costs, the efforts of the Chinese government, world shipping and global financial development.

Since the first industrial revolution, the world industrial economic pattern has actually changed from a lack of productivity to a pattern of insufficient demand. That is, the products produced by the world’s productive forces have been able to meet the needs of the public far below, so they are left to the core of the industrialists. The problem has changed from improving productivity to seeking orders, reducing costs and creating new demands. Microscopically, a factory has begun to shift from a market in short supply to a market oversupply. The main reason is that productivity is far away. Far more than the current demand, so companies must reduce costs and improve quality in order to attract customers, so as to obtain the survival of the enterprise. The most vivid case of this is the bankruptcy and bankruptcy of China's vast state-owned enterprises.

In this process, the United States, as the largest cargo owner, has fully realized the standard containerized sea-land intermodal transportation, which has greatly improved the loading and unloading efficiency of the terminal, and greatly improved the transportation cost and convenience. The impact of this part is still significant in today's Africa, the same. The transportation process will be 40%-70% higher in Africa. The urban pattern that once flourished in Hong Kong has gradually changed. The new cities represented by finance and container modern logistics have risen rapidly, and the convenient sea-land intermodal transportation has also made the production process. Gradually extending to inland cities, the division of labor in the global industrial structure has gradually sprouted.

Due to the convenience of transportation and the cost optimization, in order to reduce costs to a greater extent, a large number of factory owners began to imitate the shipping industry to find cheap labor on a global scale, thereby reducing production costs. Since the shipping industry is the oldest and first-world-oriented industry, it has the longest history of finding cheap labor.

Truth 2: Western countries also have trade protection.

As the originator of the international shipping industry, in order to protect the employment opportunities of its citizens on merchant ships, the senior crew members of the merchant ships that required the national flag must be held by their own citizens. This can also be seen from one side, trade protection and the search for cheap labor. It has been seen in developed countries early, and the need for the UK to protect the employment of its own personnel at the regulatory level also proves the importance and popularity of the use of cheap labor for industrial competition.

With the continuous strengthening of the secondary industry in the field of cheap labor, the global industrial division of labor has gradually formed: developed countries, due to high labor costs, traditional technological advantages and capital advantages, have gradually become brain-type countries and are responsible for products. R&D, design and process infusion; emerging developing countries are often responsible for the detailed design, production and modular operation of products, due to low labor costs, stable political situation and eager to improve their living standards, earning processing profits and gradually becoming a torso The country; backward developing countries can only engage in some low-end raw material supply and initial processing, earning the meager profits of serious and prosperous productivity and fierce competition.

Obviously, China before 2015 is a representative of emerging developing countries. The political situation is stable, attracting foreign investment, the people’s living standards are rising, the society is eager to improve living standards, the labor force is hardworking and the price is low. Therefore, in the international economic arena, China The rapid economic development, annual GDP growth rate of more than 7% is far behind world GDP (about 2.4%) and US GDP (2.3%), and its demand for order fulfillment has greatly promoted the city of the country. Process, transportation needs and consumer demand. It is in this process that China has gradually become the giant of the world shipping industry. The Chinese shipping industry has also developed rapidly in this process to become the world's third-largest ton-owned country (excluding Chinese Taipei, 9.08%). .

Having talked about so many stories of the past, then, can we continue to maintain the previous development model? Is it possible to return to the era of our world factory and revitalize China's shipping industry through a large number of product shipments?

The author believes that this is relatively difficult. The reason is that we have to present the truth three.

Truth 3: The government is only the leader of the economy, and the market is the essential driving force of the economy.

At present, the slowdown of China's economy is mainly due to the contradiction between the industrial structure of the trunk-type country and the ever-increasing living standards of the people. Therefore, a large number of foreign-funded enterprises and foreign funds will inevitably continue to seek cheaper labor on a global scale to replace the status of China's world factories. The outflow of this technology and capital is irreversible and people are reluctant to see and cannot change. The only thing the government can do is to slow down the process and cultivate the capital and corporate entities of the country, thereby reducing this outflow to the country. The impact of the economy. Because this outflow is the main mode of world economic development and a market-based means of rational allocation of resources.

So, how should we deal with this economic dilemma? The truth comes to answer us.

Truth four: "Internet +" and "Belt and Road" are not slogans.

China's past high-speed development theory is mainly due to the government's correct guidance to meet the needs of the world's industrial division of labor to the greatest extent. This rapid development has brought about a great improvement in people's living standards, and it has gradually increased labor costs. This increase in labor costs has gradually weakened China's advantage as the largest torso-type country, so the Chinese economy will gradually decline. It is difficult to seek industrial transformation and gradually become a brain-type country, and this may also sound the alarm for those shipbuilding companies that have been smash hit.

Here is a very straightforward example. In 2009, the price of a bottom-level sander in the shipbuilding industry was 75 yuan a day. In 2013, this price has become 200 yuan a day, but in 2013 the shipbuilding industry actually did not have more than in 2009. Too many performance improvements, but the problem is that the underlying industrial workers have strong liquidity, and the rise in the overall social wages will inevitably lead to an increase in labor prices across the industry. The shipbuilding industry, the “Made in China†that once made China proud, is also destined to transfer production capacity to Vietnam, the Philippines, and India, where labor is cheaper, leaving only two problems for the Chinese shipbuilding industry. First, how to transfer production capacity? According to the experience of Europe, the United States, Japan and South Korea in the past, the shipbuilding industry was split into two pieces, and the low-end mass-type ship type went out of the country to find a cheaper labor force. The research and development and design of high-end ship types remained in the domestic operation by mature teams. However, as far as the actual situation of China's shipbuilding industry is concerned, China has not yet developed the strength to develop high-end markets. Therefore, it is a breakthrough to continuously innovate to meet the requirements of the high-end market while allowing Chinese companies to go out and seek cheap labor to meet the demand for mass production. The key, this is actually the basis of the "Internet +" and "Belt and Road" ideas. The second question is who will transfer capacity? More straightforward, who is partially withdrawing from the Chinese market? This problem is more complicated. On the one hand, due to the lack of experience in the layout of foreign shipbuilding industry, almost any domestic shipbuilding enterprise does not want to withdraw from the familiar Chinese market. On the other hand, local governments also maintain local GDP and support employment. Continue to promote financial institutions to grant credit to the shipbuilding industry. This has intensified the competition pattern of China's shipbuilding industry to a certain extent, and the shipbuilding capacity of China, Japan and South Korea has reached more than 90% of the global new shipbuilding capacity. In an era of insufficient demand, this horrible production capacity almost makes The new shipbuilding industry is on the verge of bankruptcy.

"If you don't build a ship, you're waiting for death, and shipbuilding is looking for death." A ridiculous statement in the industry highlights the dilemma of the industry. In the face of the survival of the company, more shipyards still choose to "find death", because continuing to build a ship at least means that the company is still alive.

Since transferring production capacity has become an inevitable choice for the Chinese economy and China's shipping industry, can China's once-trunk power really transform into a brain-type country? The author's answer is yes, but the process can be lengthy and difficult. The reason is the truth five that we want to reveal.

Truth 5: The secret of the rich is not at the high end or the low end, but which model is more profitable?

The story of the wealthy Chinese sweeping Europe has long been heard, and the Chinese low-end, lack of technical content is also deeply rooted in the hearts of the people. Many people can't help but have such a question: "Since China's products are so low-end, how come these rich Chinese people who have shocked the world come from?" In fact, there is a big misunderstanding here. There is no necessary connection between low-end and making money. . A pair of low-end socks are produced in China. After deducting various expenses and taxes, the net profit margin left to Chinese factory owners may be less than 4%, but its amazing amount makes the factory owners profitable. However, due to problems such as labor costs and legal restrictions, European buyers have been unable to base themselves on international trade competition by adopting such a simple and extensive trade model. The only thing left for them is through trade reverse, legal advantage, and insurance price difference. In the same way, you earn about 2~5% of profits, so although the high-end, but the total profit is very limited. Therefore, this presents the most common mode of international trade. The main FOB export of Chinese factories and the import of foreign buyers CIF. On the surface, both buyers and sellers are making profits, and foreign buyers are higher-end, but from the essence of profits. From the perspective, Chinese factory owners have gained more profits on the basis of large-scale production.

In other words, Chinese factory owners only need to lower production costs, expand production scale, and earn orders with reasonable orders, while foreign buyers can only earn profit margins through these seemingly high-end trade methods. The survival of the enterprise. Therefore, in fact, they all make money, and there is no high-end and low-end. As China’s industrial status changes, China’s industrious and savvy factory owners will inevitably transform into the so-called “high-end†industries in the fierce market competition. The transformation of the model will also put more new demands on the Chinese shipping industry.

I talked a lot about the problems of capacity requirements. Let's talk about the issues of capacity supply and industry specificity. The reason why we want to talk together is because the specificity of the shipping industry has largely led to the current supply situation, so it is easier to understand when it comes together.

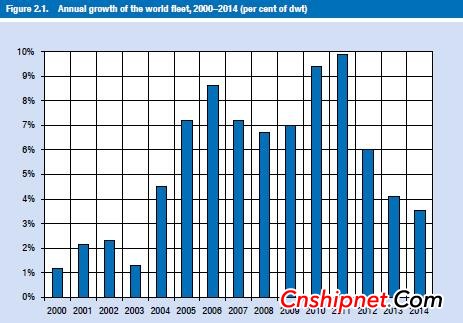

From the perspective of the four major statistical calibers of the world's shipping capacity, the transportation capacity of container transportation, other dry and bulk cargo transportation, bulk bulk transportation and crude oil transportation is very sufficient. The old-for-new replacement of container ships and bulk carriers is basically the age of the ship. It has been updated to less than 10 years, and it can be said that it has basically become a new and unrecognizable point. Since there are so many capacity, why are there so many ships delivered? This is mainly because the ship delivery has a clear “pig-bar effectâ€. From the demand proposal to the real delivery, it takes at least half a year, especially the orders accumulated during the peak period of shipping will be delivered continuously in the shipping trough. There have been a lot of reductions in delivery, but the overall increase in delivery has been reduced, but the new tonnage is still increasing, which further exacerbates the excess capacity.

Since the capacity has been surplus, why are people still reluctant to reduce capacity to ease the situation of excess capacity? This is the sixth truth about the shipping industry.

The truth is six: the freight is only maintained, the ship is the king.

BDI's sharp plunge has long been taught, but the other side of the coin is that she will suddenly rise, and the match is the soaring price of the ship, low buy and sell high, earning the difference is the most profitable crown jewel in the ship industry. . Therefore, the low level of hardship is to prepare for the future transfer of several times or even dozens of times of profit in the high position. Of course, this process of hardship is very difficult, accompanied by the risk of bankruptcy at any time, so everyone can't help but turn their attention to London in the distance. This is a lot of money that is earned by marine insurance and litigation. Shipping Finance Center.

The reason why London can become the center of international shipping finance, its strongest three major functions are ship inspection, ship insurance and ship justice, and the actual ship operation capacity has fallen to the ninth in the world in the UK, accounting for only global deadweight tons. 2.79%, and the terminal handling capacity is not worth mentioning today. However, when it comes to ship insurance and justice, Lloyd's and Anglo-American law are almost the basic common sense of the shipping industry. Is the shipping of British and American law really perfect? Since China's shipping industry must transform, can China's shipping laws and shipping finance match the needs of transformation? Look at the truth seven that we reveal.

Truth 7: The grammar is not worse than the Anglo-American law. The key is how to update.

In pursuit of the origin of the shipping industry, the British and American countries started the earliest in the ocean shipping industry, accumulating a large number of losses and responsibility division experience, especially the introduction of many special judicial concepts that are very suitable for the shipping industry, such as "presumed total loss", "common "Sea damage", etc., and the Anglo-American law is relatively more inclined to explore the nature of the case responsibility, so it often makes people feel professional, reasonable and fair. However, if you look closely at these cases, it is not difficult to find that the cases that often require careful recollection are complex and controversial cases. That is to say, the cases in which the expensive court in London will be tried at any cost are often coincident and wonderful. Cases that are both confusing and reasonable on both sides. Otherwise, before the trial, the lawyers of both parties will ask the responsible parties to settle down according to the strength of the case and the cost of litigation. Therefore, this is also the two sides of the London Judicial Coin. The high judicial expenses make the simple case quick resolution, the difficult case can be highly concentrated and can attract a large number of high-quality judicial talents. On the other hand, it also sacrifices a certain degree of judicial impartiality. (For example, a small company waives its lawsuit in the face of high litigation costs). In order to effectively change this situation, the British side has also actively established some provisions in recent years, in an attempt to regulate some commercial activities in a statute manner, and effectively keep the judicial practice up to date.

Looking at the statutes, since everything must be stated in the legal provisions, it is often difficult to clearly define the relevant responsibilities for shipping, a legal act involving a large number of objects. For example, after a ship accident occurred in a ship, the ship owner insisted on sailing to Asia to repair the ship, and suffered a typhoon, and eventually the ship sank. There are a number of causes involved here, as well as the principle of proximity, but it is inevitable that people will feel plausible if they simply copy the legal provisions and contract texts. At the same time, if we want to ensure that the statutes of the articles are advancing with the times in the true sense, we must almost constantly modify the law, which is obviously not inconsistent with the legal characteristics of the articles. At present, the most experienced maritime courts in China often use the method of adding statutes to add international jurisprudence to judge. This method can better realize the flexible operation of the statute, which is an optimal solution.

Therefore, statute law and unwritten law are not absolutely good or bad from the perspective of merits and demerits. The key to the problem lies in whether an effective system can be formed to continuously keep pace with the times and meet the needs of the development of the industry. This seems to be easy to raise questions. How did the law become a tool to meet the development needs of the industry in a flash? And see the truth eight.

Truth eight: Law is the oldest concept of crowdfunding.

In ancient times, modern law is the basic expression of the will of the masses. In criminal law, theft and murder are unacceptable to ordinary people, and naturally need to be sanctioned by law. In civil law, most of them are maintained by law. Reasonable transactions and lifestyles, such as debt repayment, labor compensation, etc.

Returning to the practice of maritime cases, whether it is the Convention on the Safety of Life at Sea or the Hague Rules, the relevant countries are weighing the pros and cons on the basis of popular cognition and representing the repeated game of national interests. Therefore, the small law and regulations and the international conventions are only a concentrated expression of the public cognition and interest game. The purpose is only to ensure that the society and the industry develop in an orderly manner according to the established fairness. Some puzzling legal provisions often become very reasonable if they are magnified to the entire society. For example, a bicycle that you spend at a high price is found to be recovered from the stolen goods of others. As an innocent third party, you actually face losses, but from the perspective of the entire social structure, the judgment resists the sale of stolen goods, inhibits the occurrence of theft, and is conducive to the development of the whole society. In the shipping industry, there are also many examples. For example, innocent shipowners under bareboat charter, on the surface, it is only a hand in legal practice, but strict liability can also effectively limit the authorization of bareboat charter. Operating. Therefore, the judicial practice of the shipping industry is not so far away, mysterious and unpredictable, as long as careful research and earnest accumulation, the Chinese shipping justice community will inevitably achieve extraordinary performance.

Of course, the development of Anglo-American law to today is a reasonable trial system formed after hundreds of years of case accumulation. China's maritime litigation and arbitration has not yet formed a particularly effective case accumulation mechanism. Therefore, it is necessary to clarify the case accumulation mechanism under the current maritime legal system framework. Get up and catch up with the times.

After talking about the shipping laws, let’s talk about shipping finance. Shipping finance includes shipping financing, shipping insurance and related derivatives transactions. Its main purpose is to provide the funds, risk dispersion and risk considerations required by shipping companies. Use industry power to calm the impact of a single incident on shipping companies. Of course, it is also emphasized here that it is a single event rather than a systemic risk. The current financial institutions' talk about the shipping industry is because the current situation is already a downturn in the whole industry. The shipping industry generally has the possibility of bad debts, so it has gone beyond the scope that financial institutions can coordinate.

Within the financial industry, the perspective has undergone complete changes, the financing end is integrated into the capital, the investment side is looking for business, the risk control side is grasping the risk access, and then the round is the risk consideration. The basis of the consideration is no longer just the shipping itself. The risks also include risk combinations with other businesses, risk transfer, liquidity requirements, cash flow income, effective bad debt rates, and so on. However, excessively radical or conservative financial policies will affect the already nervous shipping industry. At this level, China's shipping finance industry needs not only more experience, but also the transformation of China's economic volume to qualitative change.

Having talked so much, I believe that everyone basically understands why the shipping industry is so depressed. So where is the Chinese shipping industry going in the future?

The author believes that the upstream and downstream industries of the shipping industry are gradually moving to Southeast Asia. It is an inevitable reality. China’s shipbuilding enterprises will gradually compete with Japan and South Korea on high-end ship types. Towing, major transportation, equipment transportation and merchandise imports will continue. The share of China's seaborne share will gradually increase. Chinese factory owners will gradually import and export goods at CIF prices, thereby earning the transfer profits. The quantity and quality of Chinese maritime cases will be improved, and the Chinese maritime judicial system will also Will get a lot of development. Therefore, the trough of China's shipping industry today may be its biggest opportunity. It is the inevitable realization of its quantitative change to qualitative change. In fact, the road is always at the foot. Only when we stand firm, can we usher in the dawn of victory.